The purpose of this article is to explain how Prior Authorization works with Medicare. This is an important subject because the prior authorization process can factor into your decision about which type of Medicare plan you choose. Additionally, if you enroll in a plan that requires prior authorization, then it is vital to know how the process works, especially if your request is denied.

What is Prior Authorization?

Prior Authorization is a required process used by many health insurance carriers as a way to determine if they will cover a prescribed service, procedure or medication. Prior Authorization has been widely criticized by physicians for serving the cost saving interests of insurers to the detriment of policyholders.

On the positive side, physicians and insurance carriers want to ensure patients are being prescribed the safest and most effective services for their health conditions. Prior Authorization can sometimes help in this pursuit. In theory, it helps protect patients and control costs.

Prior Authorization has been around for quite some time. In fact, you might have experienced this while on a group health plan. Most non-Medicare health insurance plans require prior authorization for certain medications, tests, treatments and procedures. This is nothing new.

What’s the Big Deal about Prior Authorization?

Although this process is used to make sure care is medically necessary and appropriate for the situation, disputes arise when a medical provider recommends a treatment or service they deem appropriate, but the insurance company thinks otherwise. Denials can be hazardous to a patient’s health.

“More than nine in 10 physicians (92 percent) say that prior authorization programs have a negative impact on patient clinical outcomes, according to a physician survey released (in March 2018) by the American Medical Association (AMA).”

Additionally, “one in four doctors said the need to obtain prior authorization led to serious harm for at least one of their patients. One in three doctors surveyed have staff who work only on prior authorizations. In some cases, prior authorizations can be changed or revoked after patients receive care they thought was approved.”

According to recent – April 2021 – report by Becker’s Hospital (full report here), 90% of physicians said prior authorizations have a negative effect on patients’ clinical outcomes. Additional findings are:

- 94% of physicians said the prior authorization process delays patients’ access to necessary care.

39 percent said the prior authorization process often delays access to necessary care, and 15 percent said it always does.

- 79% of physicians said the prior authorization at least sometimes leads to treatment abandonment.

- 21% of physicians said prior authorizations have led to a patient’s hospitalization, 18 percent said they led to a life-threatening event or required intervention to prevent permanent damage and 9 percent said they led to a disability or permanent body damage.

Medicare Supplement and Medicare Advantage

Medicare Supplement (Medigap) plans – which supplement Original Medicare – do not require Prior Authorization (with limited exceptions). Almost all Medicare Advantage (MA) plans do require Prior Authorization.

While Medicare Advantage plans, which replace Original Medicare, are required by law to provide the same or better coverage as Original Medicare, there is no requirement for MA plans to offer similar provider access. Additionally, they can impose restrictions on coverage—like prior authorization—that require policyholders to take certain steps before receiving care prescribed by their doctor.

This is a concern because as you get older you are much more likely to need medical services. You are less likely to effectively deal with the obstacles imposed by PA at an advanced age, especially when it is used improperly. Remember, this is likely to occur when you are in poor health and in a weakened state.

With MA plans, claims or requests for prior authorization are sent to the private insurance company (United Healthcare, Humana, Aetna, Cigna, etc.). These MA carriers administer Medicare Parts A and B, so everything “goes through the carrier”. With a Medigap plan, claims go to Medicare and then to the Medigap carrier to pay what Medicare does not pay. They fill in the gaps, so to speak.

As mentioned previously, Medicare has required prior authorization for limited services such as home health care. Due to widespread fraud in this area, CMS has imposed stiffer requirements for these services. Prescriptions for Durable Medical Equipment (wheelchairs, stairlifts, prosthetics, etc.) is also an area that has seen widespread fraud and is now subject to prior authorization.

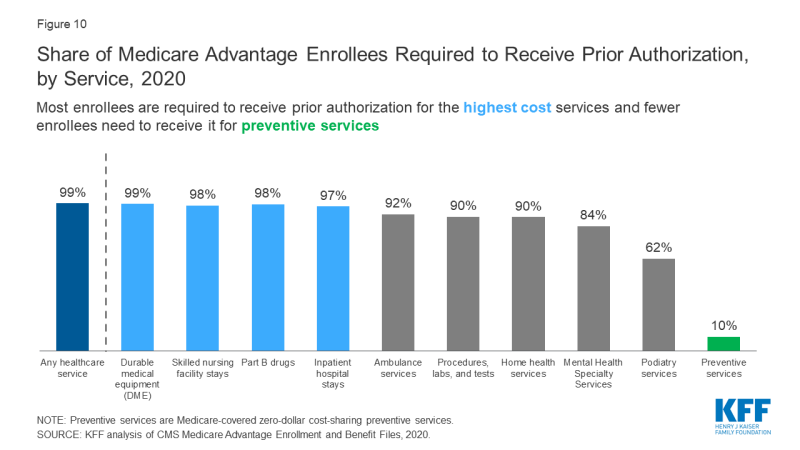

A Graphic by Kaiser Family Foundation

Medicare Provider Networks and Prior Authorization

This in another area that differs with Medigap plans and Medicare Advantage plans. Medigap plans allow you to see any provider that accepts Medicare Assignment. MA plans require you stay within their provider network for lower cost sharing. If you have an HMO plan, then you must stay in the provider network or pay all out-of-network costs. PPO plans allow you to go out-of-network but pay higher cost-sharing.

If you need to see a specialist that is not in your plan’s provider network, then you can make the request through prior authorization. This can be important because many plans have a shortage of certain specialists.

According to a Kaiser Family Foundation Study in 2015, the availability of specialists in most plans – even PPO plans – can be exceptionally low, depending on geographic area.

- 20% of plans included less than five cardiothoracic surgeons

- 18% of plans included less than five neurosurgeons

- 16% of plans included less than five plastic surgeons

- 16% of plans included less than five radiation oncologists

Part D Plans Require Prior Authorization

PA is one of the usage management tools used by Medicare Part D (prescription drug) plans. With Medicare Advantage plans, the drug plan is typically included as a part of the comprehensive coverage. For those with Medigap plans, the Part D coverage is separate. Carriers also set Quantity Limits or require Step Therapy as cost containment tools.

Checking your plan’s drug formulary is a fairly simple way to find out if a medication requires PA. A letter from your doctor explaining why a particular (usually expensive) drug is needed for your condition. Often times, a letter will suffice, but denials are not uncommon.

How to Deal with Prior Authorization Denials

It’s important to understand the way insurance companies handle requests for prior authorization.

I spoke with an experienced doctor at an inpatient rehab facility. He said that Medicare Advantage carriers will often deny prior authorization requests as a “filter”. This managed care approach is a money-saver. They will limit access to care and services through a review board and then use the appeals process to assess the situation more thoroughly, requiring supporting documentation that could have been obtained during the initial peer-to-peer meeting.

According to this doctor, the review team will assume (despite a doctor’s order) that elderly, sick patients don’t have much rehab potential and will likely need to go to a nursing home. Again, these are cost-saving decisions that are seldom in the best interest of the patient.

This may seem dire, but on a positive note, the appeals process is usually successful. In fact, 75% of all Medicare Advantage appeals are approved according to a 2018 report by the Office of Inspector General. What is startling is that only 1% of denials for prior authorization are appealed. This is based on the same report cited above.

When a request for PA is denied, the carrier sends a letter to the insured explaining the specific reason for the denial. They also give clear instructions on how to file an appeal. For Medicare Advantage claim denials, there is a 60-day period to submit the appeal.

Get Help with the Appeals Process

It recommended that you receive the help from a spouse or relative as it is important to obtain the proper documentation from your doctors explaining why the service was incorrectly denied.

Carriers allow for an expedited appeals process when the situation is urgent. Decisions are typically made within 24 to 48 hours.

If you work with a Medicare agent, it can help to receive some advice. Additionally, there are Medicare advocacy organizations that can provide form letters, advice and support. Two organizations that deal with this issue on a regular basis as follows:

- Medicare Rights Center https://www.medicarerights.org/

- Center for Medicare Advocacy http:medicareadvocacy.org

“I’m Okay with Prior Authorization” – An Acceptable Risk for Many

Even though prior authorization can be problematic, many people are fine with this potential obstacle and risk. I have had clients tell me, “I had to deal with prior authorization in the past and it wasn’t too bad”. “If I have to cross that bridge again, I will”

I understand that reasoning. When people realize they can save a lot of money with Medicare Advantage, as opposed to purchasing Medigap and Part D, they are willing to accept more risk and potential hassle.

The premium savings can be substantial. Factoring in average rate increases on Medigap plans, the total premium for Medigap and Part D can reach $55,000 to $65,000 over the course of 20 years (for someone starting Medicare at age 65). In some areas the premium is much higher.

Conclusion

Although Prior Authorization can seem like a significant impediment to healthcare, there are many organizations and legislators who recognize the adverse impact of PA. Efforts are underway to protect Medicare beneficiaries, so things are improving in this regard.

Hopefully, this article has helped you understand how PA can affect you as it relates to Medicare and your decision-making process. If you choose a plan that requires prior authorization, you now have some basic understanding on how to deal with this process.

Written by Greg Sanders Peachtree Insurance Advisors 678-236-1600